Hey there 👋

Hope you’re doing well this week.

I’ve been digging through some African SaaS/tech growth stories lately and found two which really stand out — not the flashy ones, but the ones doing the messy, foundational work. And that’s exactly what we need when we’re scaling past the $1 M ARR mark.

So in this Playbook issue, I want to walk you through:

One startup building the infrastructure behind the scenes (your kind of “boring but high leverage” model)

One story showing how a shift in power (global incumbents pulling out + local players stepping up) creates opportunity for SaaS founders in Africa

And, importantly: what you can take away and apply in your growth process, right now.

Let’s get started.

Story #1: SehaTech – Automating Health Insurance Infrastructure in Egypt

What’s going on

SehaTech, founded in 2022 in Cairo by Mohamed Elshabrawy, Mostafa Tarek and Omar Shawky, is tackling a classic “infrastructure” problem: behind the scenes of health insurance — approvals, claims processing, payments — the system is fragmented, paper-based and slow.

They recently closed a $1.1 million seed round (bringing total to ~$2m) led by Ingressive Capital with participation from Plus VC, A15, Beltone Venture Capital.

Their platform offers:

AI & rules-engine automation of approvals, claims, payments.

A business model aimed at reducing operational cost for insurers/providers + increasing coverage by improving backend workflows.

Why this matters for SaaS founders

Here are the growth & scaling lessons you can grab:

a) The value-lever is often behind the product, not just in the user-facing feature

Many SaaS companies aim for the sexy feature front-end. SehaTech went for the “boring” admin layers — workflow, rule engines, claims automation — but that’s exactly where the inefficiency lives.

Your takeaway: Are you looking at your “backend value” (processes you improve for customers) or just front-end features? The deeper you fix the process, the more defensible your SaaS.

b) Business model aligned with region/context

Insurance in many African markets suffers from low penetration, high admin cost, manual processing. SehaTech’s model is tailored to that.

Your takeaway: When you scale SaaS across Africa or emerging markets, don’t just import global assumptions. Tune your model to local realities (payment behaviour, regulation, capacity). That gives you a competitive edge.

c) Funding signals + timing matter

SehaTech’s recent round signals investor belief in infrastructure-layer tech in Africa (not just consumer apps).

Your takeaway: When you approach growth (and possibly investment), frame your story not just as “we have product X” but “we are building the system that will underpin Y for this market.” That language rings with investors and enterprise customers alike.

d) Scalability via modular integration

SehaTech’s platform is built to plug into insurers / providers rather than replace everything from scratch. That modularism means faster onboarding and scaling.

Your takeaway: For your SaaS, ask: can you build something modular / plug-in instead of a full rebuild for each client? That’ll help you scale faster and reduce implementation friction.

What you should do this month

Map one “hidden workflow” inside your customer’s business (the thing they loathe but must do). What if you fixed that for them?

Sketch a modular “plug-in” version of your offering: can you separate the part that delivers maximum value and offer it as a fast-onboarding module?

Identify one investor/person in your network who believes in “infrastructure + region-specific SaaS” and send them a 1-pager framing your product as that kind of bet.

Story #2: The shift in banking/fintech — global giants stepping back, local SaaS & fintechs stepping up

What’s going on

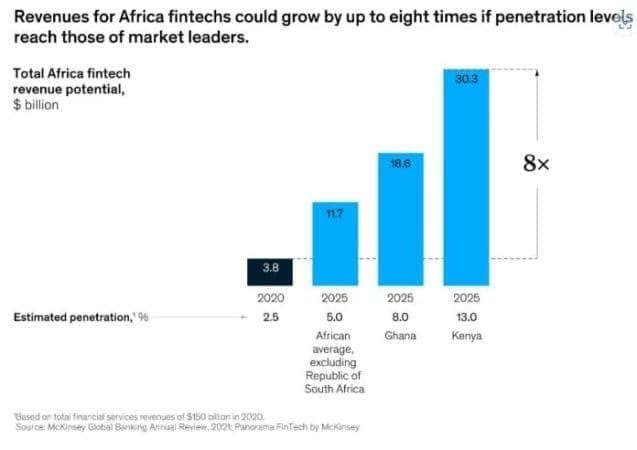

Over the past decade, an important trend: many global banking giants have scaled back operations in Africa, opening a gap for local banks, fintechs and SaaS players.

Key reasons: rising compliance costs, currency/market risk, fintech competition.

On the flip side, local/regional players that know the context intimately are stepping up — this creates opportunity not just in fintech but in SaaS that supports these players.

Why this matters for SaaS founders

a) Falling incumbents = rising opportunity

When global firms pull out, they leave technical debt, outdated systems, customer pain. That becomes your space.

Your takeaway: Position your SaaS as the tool that local/regional operators need now because the old guard is stepping back. The timing is favourable.

b) Local insight wins over scale alone

Global players often assume scale from one size fits all. Local players succeed because they understand culture, behaviour, risk. SaaS built for those behaviours wins.

Your takeaway: Make sure your product isn’t just “West-ified SaaS”. If you’re in Africa, build with local habits, local payment flows, local language/context. That gives you defensibility.

c) Shift from competition to collaboration

As local banking/fintech ecosystems grow, SaaS can serve as enabler rather than challenger. Instead of “we compete with banks”, you say “we empower banks/fintechs to do more with less”.

Your takeaway: Describe your customer not as “bank vs startup” but “bank/fintech partner”. That opens different go-to-market routes and growth trajectories.

What you should do this month

Pick one industry adjacent to your SaaS (e.g., fintech, banking operations, payments) where incumbents are vulnerable or outsourcing.

Create a customer pitch deck where you talk to that industry partner: “Here’s how your workflow will change when you adopt our SaaS.” Emphasise local context, cost cut, risk mitigation.

Reach out to one local/regional operator (bank, larger fintech) with a value-map: what you fix, how you integrate, why now.

Bringing it together: Your 30-Day Growth Plan

Here’s a quick plan based on these stories — pick one from each bucket and get moving:

Week | Focus | Outcome |

|---|---|---|

Week 1 | Hidden workflow mapping | Identify one backend process your SaaS can fix |

Week 2 | Modular product sketch | Define a quick-onboard “module” of your SaaS |

Week 3 | Industry partner mapping | Choose one adjacent industry (e.g., fintech, bank ops) |

Week 4 | Outreach + story | Reach out with your pitch + narrative: “We’re the local fit you need now” |

If you track just one KPI this month (say, one new partner conversation, one module defined), you’ll already be ahead of many trying to scale.

What’s Next & How I Can Help

Also — if you missed it, we held a webinar with Anthony Ndolo on “Scaling Smart: Operational Excellence & Exit Readiness in African SaaS”. The recording is now live in our community for all members — you’ll get the frameworks + Q&A. Watch here

Don’t forget: I post weekly on LinkedIn with founder stories from across Africa (the value you won’t read in the mainstream). If you haven’t followed my personal page, hit it up.

And the Smarter SaaS Growth LinkedIn page is there for ecosystem updates and upcoming events. (No pressure — just good community.)

Thanks for reading this far — I know your schedule is packed, so I’ll keep this short and sweet.

If you do apply one takeaway from this newsletter by next week, shoot me a reply and let me know which one. I’d love to hear where you’re leaning in.

Keep building smart. The next $1 M ARR milestone is well within reach.

Talk soon,

Angela.

Founder, Smarter SaaS Growth

P.S. Know a SaaS founder in Africa who’s stuck in the $500K-$1M zone? Forward them this email — they’ll thank you.